Today Glenigan, one of the construction industry’s leading insight and intelligence experts, releases the November 2022 edition on its Construction Review.

The Review focuses on the three months to the end of October 2022, covering all major (>£100M) and underlying (<£100M) projects, with all underlying figures seasonally adjusted.

It’s a report which provides a detailed and comprehensive analysis of year-on-year construction data.

The key takeaway of the November Review is a softening in the downward trajectory of project-starts registered throughout the second half of 2022. However, this brief period of respite should be approached with caution as geopolitical turmoil persists in Eastern Europe, material and energy costs soar, and the UK enters a recession.

Whilst the sector overall experienced relative stability in the three months to October, with project start levels remaining largely unchanged, figures were still down 4% against the previous year.

Underlying Issues

Major project starts performed well, helping to maintain sector-wide stability, rising an impressive 28% on the preceding three months to stand 19% up on a year ago.

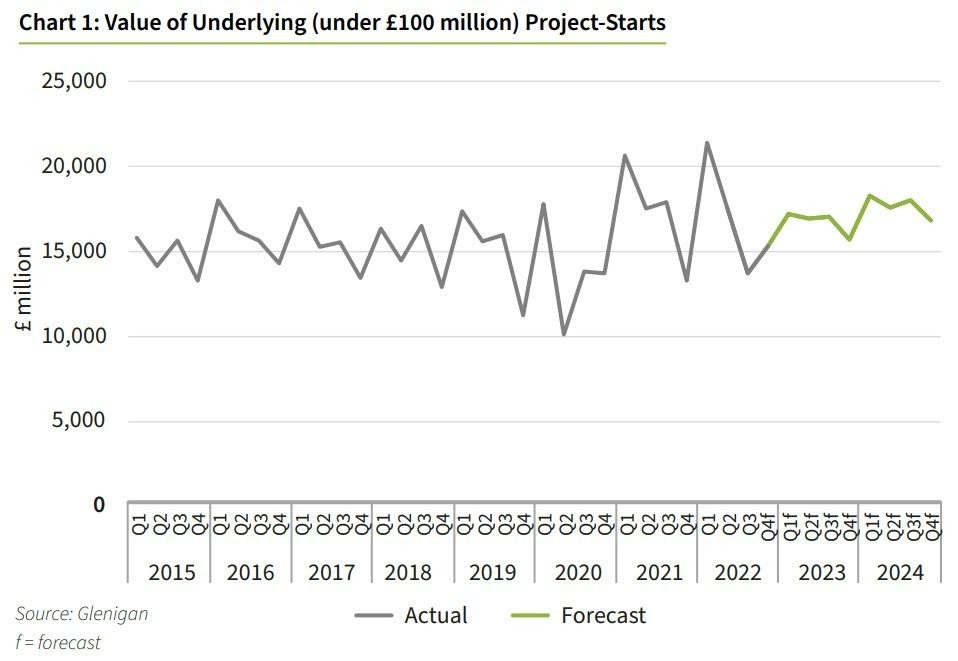

The same could not be said for underlying project starts, which plummeted 17% against the previous three months and were 13% down on 2021 levels.

Overall main contract awards slipped back 7% against the preceding three months, 5% lower than a year ago. Although major projects performed well, growing almost a quarter (24%) on 2021 levels and up by a fifth on the three months to October, underlying projects declined by 13% against last year and 15% compared to the previous three months.

Despite the November Review’s generally sluggish outlook, there are indications of gradual recovery, with a pipeline of work starting to flow following almost six months of blockage. Refreshingly, detailed planning approvals were up 29% against the preceding three months and a nifty 22% higher than 2021 levels.

Major projects rose a stunning 99% compared to the previous three months and an even more monumental 126% up on last year’s figures. Underlying approvals dipped a modest 2% on 2021 but, encouragingly, increased 8% on the preceding three months.

Commenting on the results, Glenigan’s Economic Director, Allan Wilen, says, “UK construction continues to be buffeted by myriad external headwinds, many of which are entirely out of the industry’s control. However, it was encouraging to see a significant uplift in major projects over the period covered by the Review.

“Of course, the release of the November Review comes in the wake of The Chancellor’s sober Autumn Statement, which will no doubt have an effect on future iterations of this report. Significantly, as part of his drive for growth, Hunt outlined the largest public works package for 40 years and substantial funding for critical infrastructure, which will no doubt provide the shot in the arm many contractors have been looking for. Furthermore, the commitment to reduce built environment emissions by 15% by 2030 will provide plenty of opportunities for retrofit specialists.

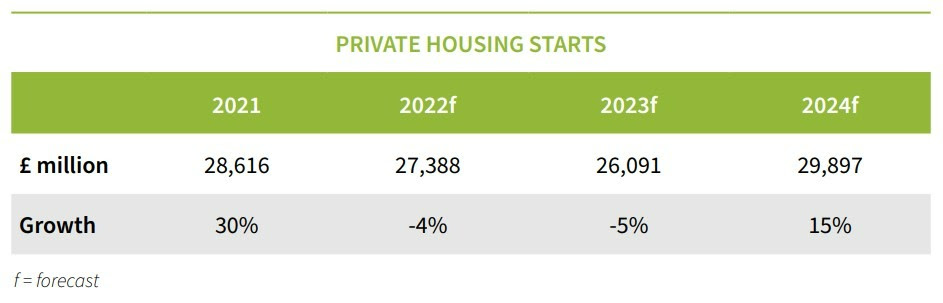

“No doubt many housebuilders and developers will feel let down, particularly as the one significant point around the ending of Stamp Duty relief will no doubt disincentivise potential buyers in the second half of 2023.”

The Sector specific and regional Index, which measures underlying project performance, was characterised by a bottoming out of project-start levels. However, recent events have dented market confidence, meaning levels remain relatively depressed.

Sector Analysis – Residential

The value of residential work starting on site fell 21% against the preceding three month period to stand 10% lower than a year ago.

Drilling down into the figures, social housing project starts fell a substantial 26% on 2021 levels, yet fared less poorly against the previous three months to the end of October, only dipping 7%. This was a relatively good performance compared to other verticals.

In contrast, private housing dropped 24% compared to the preceding 3 months but only 6% against 2021 levels.

Sector Analysis – Non Residential

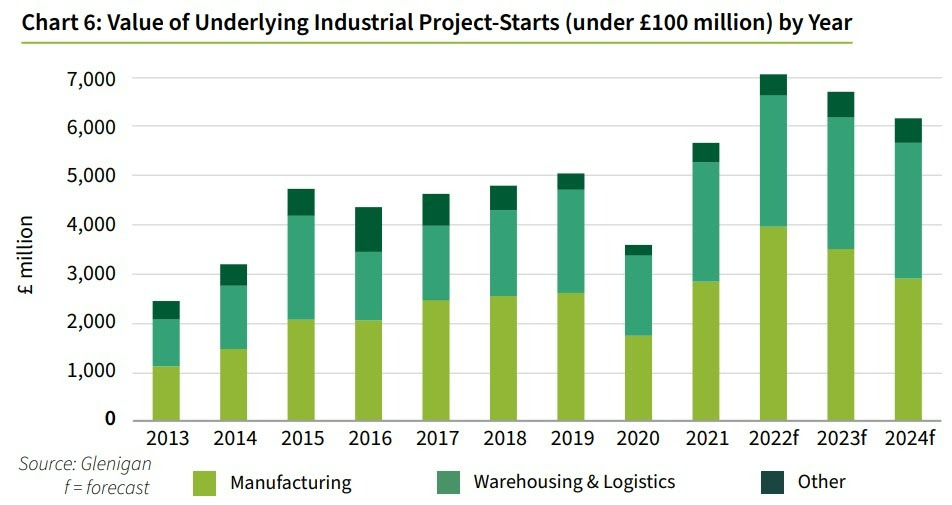

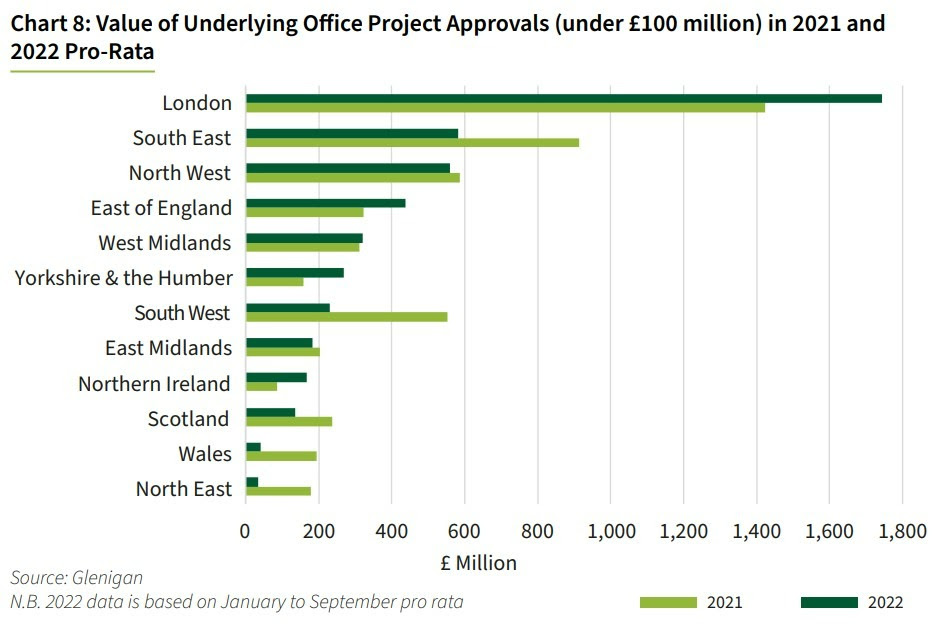

Bright spots were few and far between, however, office project starts experienced a good period, rising 11% against the preceding three month period to remain unchanged on a year ago. Industrial starts also experienced modest growth during the Review period, but remained 15% behind 2021 figures.

Hotel and leisure experienced the sharpest decline of any vertical (-38%) against the previous year, also slipping back 19% against the preceding three months.

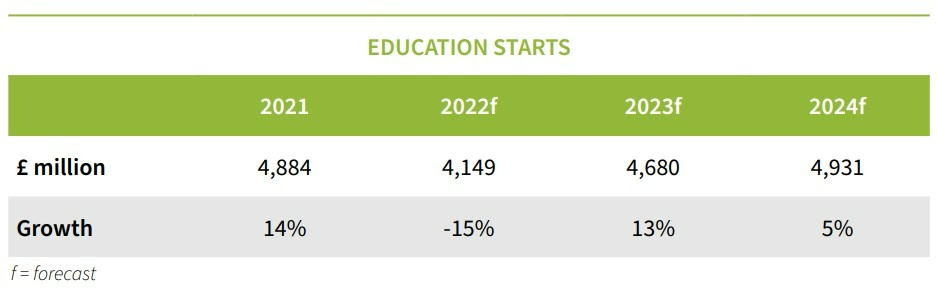

Education (-24%) and health (-41%) fared little better in the three months to the end of October, respectively crashing 28% and 31% compared to 2021.

Utilities construction starts were the only ones to experience growth on last year (+14%), despite tumbling 15% against the previous three months. Looking at the wider civils landscape, work starting on site slipped back 13% against the previous three months to remain largely unchanged on a year ago.

Regional Performance

Regional performance was generally weak.

Once again, Northern Ireland posted the most positive results, increasing 16% against the preceding three months, to stand an impressive 35% higher than a year ago.

Scotland also had reasons to be cheerful, with starts 10% up on 2021 and 19% up on the preceding three months.

Whilst project starts in Wales advanced on a year ago (+25%), they slipped back 5% on the preceding three months. The North West performed relatively well compared with other regions and, whilst project-starts remained unchanged on the previous three months, they dipped 2% against the previous year.

All other regions experience a decline against the preceding three months and previous year.

To find out more about Glenigan click here.